The Republican Budget Busting Bill Has Passed - It is a Disaster, Unless You Are Filthy Rich

What is In and What is Out?

When discussing this bill, I feel it necessary to reiterate something I genuinely believe in. In Economics, one learns that how you lay out a budget is filled with moral decisions. Budgets reveal priorities and values, and as a society, government budgets determine the primary way that we care for one another, especially the vulnerable.

This budget bill is revealing a part of America’s morality that is antithetical to what I think of America.

The bill is disastrous for most people, but beneficial for the ultra-wealthy.

The nearly 900-page bill contains handouts for special interests, some of which we won’t fully understand for months. According to the Congressional Budget Office (CBO), the bill is projected to increase the deficit by $3.3 trillion over the next decade, through 2034.

Many of the items that will balloon the deficit are carve-outs to Trump cronies. A small list includes:

Over $150 billion in handouts for Pentagon contractors (including $25 billion for Trump’s Golden Dome,

Billion-dollar giveaways to oil, gas, and western water projects. The legislation mandates lease sales on federal lands and waters. Specifically, two lease sales in the Gulf of Mexico, quarterly lease sales onshore, and sales in Alaska. These lease sales are expected to be in the state’s Cook Inlet, National Petroleum Reserve, and Arctic National Wildlife Refuge.

It decimates all the good done under Biden in the field of renewable energy. It

ends $7,500 EV tax credit by 2025, provides a production tax credit for metallurgical coal, and slashes wind and solar incentives unless completed by 2028.

There’s a $17 billion expansion of a little-known provision that enables venture capitalists to make a fortune tax-free.

To secure Lisa Murskowski’s vote, it includes tax benefits for Alaskan whalers.

There’s a $2 billion break important to the rum industry and, tangentially, Louisiana.

Mitch McConnell secured a $7 billion tax cut for farmers that allows them to postpone paying some of the capital gains taxes they owe when selling off farmland.

There’s a $1 billion provision that allows spaceports to qualify for tax-exempt “exempt facility bonds,” a public financing tool typically used for public infrastructure projects such as airports. Spaceports are defined as facilities close to a launch site that are used to manufacture, assemble, or repair spacecraft, or used for flight control operations. Prompting Senator Ron Wyden to post on X that “Trump’s wedding gift to [Jeff] Bezos and birthday gift to [Elon] Musk were tucked in the new budget bill.”

The NRA won on a provision of the bill that eliminates the $200 federal tax on the purchase of firearm silencers and short-barrel rifles, as outlined in the 1934 National Firearms Act.

Drug companies successfully pushed for the bill to include the ORPHAN Cures Act, which exempts more drugs from being subject to price negotiations with Medicare.

The bill provides $40 million to establish Trump’s long-sought “National Garden of American Heroes.”

ICE Wins Big

To boost Trump’s cruel policy of rounding up innocent undocumented immigrants and disappearing them, ICE will receive $150 billion over four years.

The bill allocates $29.9 billion for ICE activities, including hiring new agents and securing transportation contracts to move migrants between detention centers and facilitate deportations..

It sets aside $59 billion to militarize the border, which includes wall construction, CBP agents and vehicles, and border surveillance technology.

It includes $10 billion for grants to reimburse states that enact anti-immigrant policies, as well as another $1 billion for the Department of Defense to deploy military personnel to the border and to detain migrants.

The figure is the single largest increase in immigration enforcement in US history.

The ICE budget is now more than the annual military budget of Italy, which at $30.8 billion, is the world's 16th highest defense spender. It is also higher than military spending for Israel ($30 billion), the Netherlands ($27 billion), and Brazil ($26.1 billion).

It is larger than the combined budget for all 50 prison systems, which is currently just over $8.3 billion.

It is larger than the former budget for USAID, and the increase is greater than the budget cuts to education, SNAP, and larger than the cuts to NIH, CDC, and cancer research combined.

Debt Limit

The bill also increased the US government’s $36.1 trillion borrowing limit by $5 trillion. U.S. Treasury Secretary Scott Bessent had predicted the government would have hit the prior limit by August, at which point it could have defaulted on its debt and sparked a financial crisis.

Social Security

It is being touted that the bill eliminates taxes on Social Security. It does not. The bill introduces a temporary deduction that beneficiaries can claim to lower their federal income tax. Notably, that deduction applies to all of a senior's income, not just to Social Security benefits.

Eliminating taxes on Social Security under the bill was not possible due to the Byrd Rule, a congressional restriction that limits what the Senate can include in a reconciliation bill.

Consequences

The market is unlikely to be pleased with this multi-trillion-dollar debt.

BlackRock had already warned that foreign buyers were growing increasingly wary of American debt. “We’ve been highlighting the precarious position of the U.S. government’s indebtedness for some time now, and, if left unchecked, we view debt as the single greatest risk to the ‘special status’ of the U.S. in financial markets.”

Most of the exorbitant deficit increase is due to the extension of the 2017 tax cuts.

In his first term, Trump signed the Tax Cuts and Jobs Act, which lowered taxes and increased the standard deduction for all taxpayers, but essentially benefited high earners more. Those provisions were set to expire at the end of this year, but this bill has made them permanent.

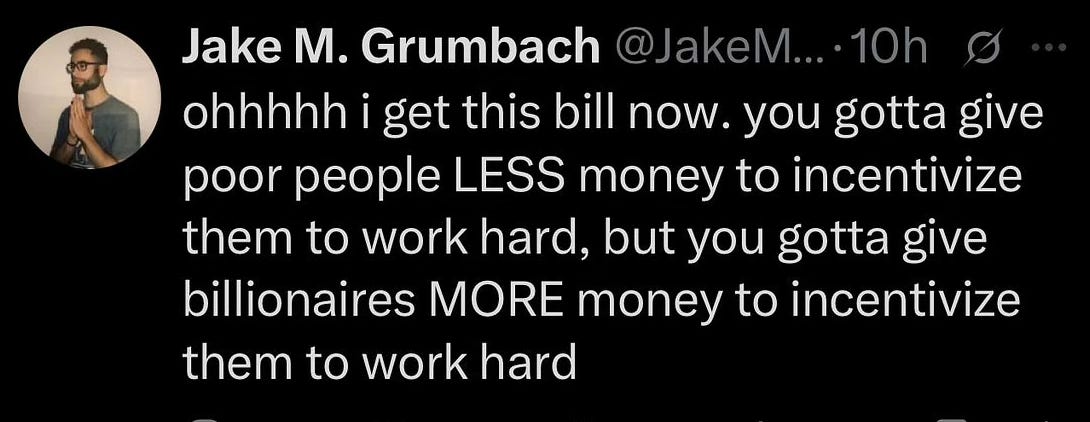

In this bill, there are tax cuts for those who fall within what is defined as the middle class, including exemption from tax on tips and overtime, as well as a break on car loans. However, unlike the cuts for the uber-wealthy, these cuts expire in 2028.

Cuts to Medicaid

Cuts to Medicaid will result in a loss of coverage for nearly 12 million Americans over the next 10 years.

The cuts to Medicaid are implemented through the provider tax, a method that allows states to receive additional federal funding for their Medicaid programs. This large loss of recipients is expected to have a profound impact on more than 700 rural hospitals already at risk of closure.

The bill provides $10 billion annually to rural hospitals over a five-year period, totaling $50 billion. According to experts, this is not enough to stave off closures.

This is a burden to the entire system. People will have to find treatment at the remaining health care providers. Now, many of those same people will be uninsured, draining hospital finances and potentially adding more closures.

This is coupled with the fact that Planned Parenthood is now excluded from federal Medicaid dollars for one year, meaning that about 200 of its roughly 600 clinics will probably have to close. Planned Parenthood is a nonprofit that serves more than 2 million patients a year. Yes, this will make abortion less accessible even in states where it is legal, but it will also put contraception, STD, and cancer screenings out of reach for untold numbers of American women.

The bill prohibits federal matching funds for “gender transition procedures,” including puberty blockers, hormonal treatments, and reconstructive surgeries for any individual enrolled in Medicaid or the Children’s Health Insurance Program.

Cuts to Medicare

Despite the consistent yelling that lawmakers will not cut Medicare, there will be $490 billion in Medicare cuts over the next decade.

These cuts, which have been known to lawmakers since May, are mandated by the Statutory Pay-As-You-Go (PAYGO) Act of 2010. This act requires the Office of Management and Budget (OMB) to track the cumulative effects of legislation on the budget deficit. Trump’s bill has initiated automatic sequestration cuts to help pay for this deficit. OMB will be required to issue an order reducing spending by $330 billion by January 2026. Many accounts are exempt from sequestration, including Social Security and several programs that affect low-income Americans. But Medicare is not.

There is a limitation on Medicare cuts of 4 percent of the program. In fiscal year 2026, that would come out to $45 billion. These cuts would increase with the program's growth, reaching $75 billion by 2034, according to the CBO. The total ten-year cuts would equal $490 billion.

While many of the safety-net cuts in the bill are delayed to help Republicans with their re-election campaigns, the Medicare cuts are scheduled to take effect next year.

SNAP

Cuts to SNAP are so large that they cannot be made up with additional state spending; some people who are eating today because they have food assistance will go hungry in the future. This includes more than 18 million kids who will lose access to the school meal program. This is happening at the same time that food banks are finding it increasingly challenging to provide food for those who come to their doors.

Student Loans

The student loan program is about to undergo a massive change, making it very difficult for people to qualify. There are many changes, but the ones that affect anyone with a student loan will take effect immediately. The bill fully repeals the Pay-As-You-Earn and SAVE plans, two of the most affordable income-driven repayment plan options. These plans allow borrowers to make payments based on a formula applied to their income, with student loan forgiveness for any remaining balance after 20 or 25 years. New borrowers would be cut off from PAYE and SAVE by July 2026, and the programs would be fully phased out by July 2028.

Included in the bill is a $1,700 tax credit for individuals who contribute to nonprofit organizations that offer scholarships to elementary and secondary students, essentially a voucher program.

Health Care for Green Card Holders

Presently, green card holders, refugees, survivors of domestic violence, and individuals on work and student visas can purchase health insurance on the Obamacare marketplace. Some are also eligible for coverage through Medicaid and Medicare.

Under the bill, only green card holders, immigrants from Cuba and Haiti, and immigrants from certain Pacific Island countries are eligible for federally funded health care.

Changes Made At the Last Minute

A provision that would have prevented states from regulating artificial intelligence over the next 10 years was removed.

Also removed was the controversial measure that would have allowed the sale of federal land to address the housing crisis

Section 70302, which could have made it easier for Trump to disregard federal court rulings, required parties seeking preliminary injunctions or temporary restraining orders to put down a “security,” such as a cash bond, before the court could issue contempt penalties. The parliamentarian removed this as it violated the Byrd Rule.

It will make us sicker, poorer, more fearful, more ignorant, and more endangered. It will make the rich, meanwhile, even richer.

Do I have faith that the Republicans who voted for this at the suffering of their own constituents will pay for it during the midterms? Not really. They have ensured that the tax cuts take effect immediately, while pushing off reductions in spending for lower-income families until after the midterms, and in some cases, until after Trump leaves office.

Here’s a summary of when provisions in the bill go into effect.

TAX CUTS

Higher standard deduction - Starting in 2025

No taxes on tips and overtime - Starting in 2025

Higher caps on state/local taxes - Starting in 2025

SAFETY NET CUTS

Food stamp work requirements - Potentially in 2025

New rules on health insurance - Starting in 2026

Medicaid work requirements - December 31, 2026, for most states

Medicaid and food stamp cuts - Starting in 2028

CLEAN ENERGY CUTS

Electric vehicle credits - Ends by September 30, 2025

Home energy credits - Ends by December 31, 2025

“To secure Susan Collins’ vote, it includes tax benefits for Alaskan whalers.” Susan Collins is the senator from Maine it’s Lisa Murskowski from Alaska who got the carve out, the sniveling coward. It’s all so horrific.

To secure Susan Collins’ vote, it includes tax benefits for Alaskan whalers.”